Progressive taxes are theft

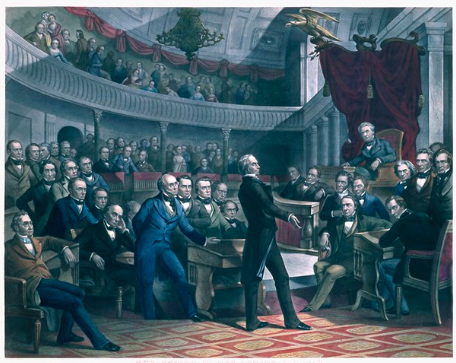

The United States Senate in 1850. Image from the United States Senate

Feb 24, 2021

Over the years, I have concluded that some people simply refuse to fully comprehend the reality of governmental taxation and spending. These individuals don’t seem to realize that the government is spending our money.

This may sound silly because on its face, these concepts are exceptionally basic. With that said, the advocacy of fiscal policies espoused by some of these individuals are illogical.

One such policy is the progressive tax. The obvious immorality of the progressive tax system (which is an increase in the tax rate as taxable income increases) should be the enemy of anyone in search of legitimate freedom.

Progressive taxes essentially seek to redistribute the wealth from one group of people to another. Politicians advocating for increased taxes on higher earners are saying, “Vote for me, and I will use the levers of power to take their money and give it to you!”

Over time, the government has grown exponentially larger and continues to infringe upon our fundamental liberties. As a society, we have allowed this enlarged government to legalize theft right before our eyes. When Congress confiscates the dollar of one person to reallocate it to another, nobody raises an eyebrow. If a private citizen carried out this action, we would deem them guilty of theft.

Earnings are personal property, just like a house or car. You are in no way entitled to the money of others, and any argument in defense of such a claim is an overt fallacy. An attack on the personal property of others is an attack on freedom. Freedom can hardly be exercised when property is being disproportionately confiscated based on income levels.

Proponents of the progressive tax system may justify taxing those with higher income by pointing to the many expenses that require government finance. To that, I would present a laundry list of wasteful government spending that provides zero value to the American people. Here are a few items on the ever-growing list:

- $72 billion in 2008 towards improper payments

- $25 billion annually for maintaining unused or vacant federal property

- $150,000 in 2016 to investigate supernatural events in Alaska

- $1.3 billion in military aid to Egypt

- $25 million for gender equity and democracy promotion programs in Pakistan

The final two examples are part of the latest COVID-19 relief package, which is supposedly aimed at stimulating the strained American economy. One can only scratch their head at the thought of sending money abroad in such a package, especially for expenses unrelated to the pandemic.

Due to hyperpartisanship, Congress is typically capable of only passing massive spending bills that do more for lobbyists and special interests than for Americans. Presently, the Biden Administration is pushing for another relief package of over $1 trillion, even though there is still about $1 trillion yet to be spent from the last relief bill.

Along with the federal government, 32 states (including Ohio) tax their residents’ income using the progressive tax model. Nine use a flat income tax structure while the remaining nine have no income tax at all.

New York, a state with a large progressive tax, found itself begging the federal government for a bailout last year because of its poorly managed budget. New York spends approximately $5,231 per resident (with a population of 19 million). Florida, a state with no income tax, spends approximately $2,327 per resident (with a population of 21 million). Had New York spent the same amount per resident as Florida, it would have saved over $56 billion per year.

The flat tax isn’t about protecting the rich. It’s about protecting hardworking middle class individuals. It’s about protecting those who decided to be smart with their money, work longer hours and demonstrate discipline with their spending.

For example, if I make $10,000 per year, and you make $1 million per year, we should both be paying the same proportion in taxes. If income taxes are set at 10%, I will have to contribute $1,000 while you contribute $100,000. Why should we be punishing you or your success by demanding that you put more in the bucket? After all, you just contributed $100,000.

Flat taxes would also make politicians think twice before raising taxes. A majority of the country could no longer demand that those earning more pay a higher price towards the general welfare.

The point is, not only does the government not need any more of our money, but they need to stop taking so much of it. We can start this process by eradicating immoral progressive taxes, simplifying the tax code, eliminating tax loopholes and adopting flat income taxes across the board. The flat income tax is the most inherently equal tax model.

A great American thinker and economist, the late Walter E. Williams once said, “But let me offer you my definition of social justice: I keep what I earn and you keep what you earn. Do you disagree? Well then tell me how much of what I earn belongs to you — and why?”

Patsy Anderson • Feb 25, 2021 at 7:38 pm

Explained very well. Will definitely share with others just hoping they will read.